Managing money as a single mom can feel overwhelming. One income, rising costs, unexpected expenses—and somehow you’re supposed to plan for the future too. That’s why practical budgeting tips for single moms focus on simplicity and consistency rather than perfection. Start by understanding your monthly essentials—housing, utilities, groceries, childcare, and transportation—so you know exactly what must be covered first. From there, create a realistic spending plan that includes small savings goals, even if it’s only a few dollars each week.

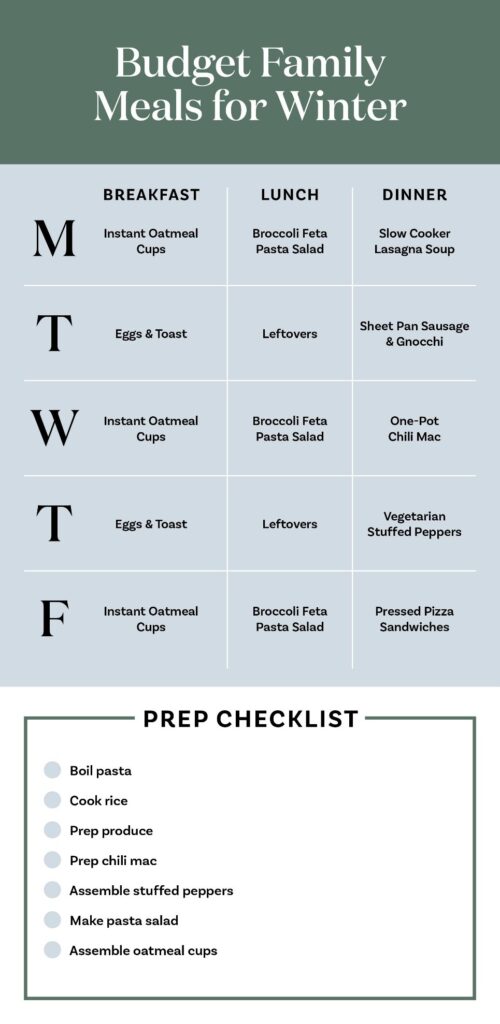

Using tools like automatic bill pay can help avoid late fees, while meal planning and shopping with a list can stretch your grocery budget further. It’s also helpful to build a small emergency cushion over time so unexpected costs don’t derail your finances.

Budgeting isn’t about depriving yourself or your children; it’s about creating a clear, manageable system that reduces stress, helps you stay organized, and allows you to build financial stability one step at a time. But budgeting as a single parent isn’t about restriction or giving up every little joy. It’s about creating a system that helps you feel more in control, less stressed, and able to take care of your family without constant worry.

Singles often face higher per-person housing and living costs, which makes saving harder without shared expenses.

According to the FDIC, Single parents are more likely to be financially vulnerable and have lower savings and access to credit than national averages.

Here are budgeting tips that actually work in real life.

Start With Your “Must-Haves,” Not Your “Cutbacks”

Instead of immediately looking for what to eliminate, focus first on what truly matters:

- Housing

- Utilities

- Food

- Childcare

- Transportation

- Insurance

- Debt obligations

These budgeting tips are your foundation. A realistic budget prioritizes stability before anything else. Once these are clear, everything else becomes easier to manage.

Use a Simple System (Complicated Budgets Don’t Last)

You don’t need fancy spreadsheets or financial apps if they overwhelm you. Try this three-category approach:

- Needs – Bills and essentials

- Life – Groceries, gas, school costs, kids’ activities

- Future You – Savings, even if it’s small

That’s it. Simple systems are easier to stick to when life gets busy.

Build an Emergency Fund—One Tiny Step at a Time

About 60% of single parents lack an emergency fund, leaving them more exposed to debt when unexpected expenses arise.

Many single moms feel like saving is impossible. But an emergency fund doesn’t start with thousands. It starts with consistency.

Try:

- Saving $10–$20 per paycheck

- Putting aside tax refunds or small bonuses

- Automatically transferring a small amount to savings

Even $300–$500 can prevent a crisis from turning into debt.

Lower Expenses Without Feeling Deprived

Budgeting shouldn’t feel like punishment. Instead of cutting everything, look for swaps that reduce costs without reducing quality of life.

Examples:

- Meal plan to avoid last-minute takeout

- Buy in bulk for items you always use

- Use community resources like libraries, free events, and local programs

- Rotate kids’ toys and clothes instead of constantly buying new

- Share childcare or carpool with another parent

These changes add up without making life feel smaller.

Plan for “Irregular” Expenses (They’re Not Actually Surprises)

Back-to-school shopping. Holidays. Birthdays. Car maintenance.

These feel like emergencies—but they happen every year.

Create a small monthly sinking fund:

- Set aside $15–$25 a month for these categories

- When the expense comes, you’re ready

- No credit cards. No panic.

Give Yourself Permission to Include Joy

This is where many budgets fail—they leave no room for living.

If every dollar is assigned to survival, burnout follows quickly. Include something small that makes life feel good:

- A monthly coffee date

- A family movie night

- A low-cost outing with your kids

- A hobby or treat you look forward to

A sustainable budget includes emotional well-being too.

Use Tools That Save Time (Because Time Is Money Too)

As a single mom, convenience matters. Look for systems that reduce decision fatigue:

- Automatic bill pay to avoid late fees

- Grocery pickup to prevent impulse spending

- Calendar reminders for due dates

- One weekly “money check-in” instead of daily stress

Efficiency is a financial strategy.

The most important of all the budgeting tips: Focus on Progress, Not Perfection

Living costs in many U.S. cities exceed the average income for single parents, highlighting the structural financial strain they face.

Some months will go smoothly. Others won’t. Unexpected things happen—that’s part of single parenting.

A good budget isn’t rigid. It adjusts with your life.

What matters is that you:

- Know where your money is going

- Have a plan (even a loose one)

- Are building stability little by little

Remember: This Is About Security, Not Sacrifice

Budgeting isn’t about saying “no” to everything.

It’s about saying “yes” to peace of mind.

Every small step you take—every dollar saved, every plan made—is building a safer, more stable future for you and your children.

And that’s not just smart. It’s powerful. I hope these budgeting tips were helpful to your needs.

Explore our blog for more insights and helpful information.

Click here to learn more about our career and coaching services.

Have questions or feedback? Visit our Contact page (click here) — we’d love to hear from you.